Business Email Compromise (BEC): Understanding the Threat and Building Effective Defenses

Business Email Compromise (BEC) has emerged as one of the most financially damaging forms of cybercrime. Rather than relying on malware or brute force intrusions, BEC attacks leverage social engineering, email spoofing, and credential theft to manipulate victims into transferring funds or sensitive information.

In this article, we explore how BEC attacks operate, why they are so dangerous, and how organizations can build multi-layered defenses to reduce their exposure.

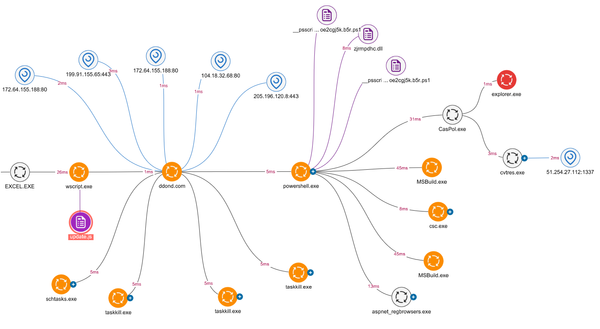

The Anatomy of a BEC Attack

A typical BEC campaign begins with reconnaissance—threat actors gather details about the target company, executives, vendors, and payment procedures. They then:

- Compromise or spoof an executive’s email account

- Craft convincing messages to accounting or finance teams

- Urge the recipient to process urgent wire transfers or share sensitive data

- Often time the attack during weekends, travel, or holidays to avoid verification

Unlike traditional phishing, BEC rarely involves malware, making it harder to detect with signature-based tools.

Common BEC Techniques

Several vectors are used to launch BEC attacks:

- Email Spoofing: Faking the "From" address to appear legitimate

- Lookalike Domains: Registering domains that closely resemble the victim’s

- Account Takeover: Using stolen credentials to send emails from real accounts

- Vendor Email Compromise (VEC): Compromising a vendor and hijacking real invoice threads

🔗 Learn more about social engineering and phishing:

- Phishing Simulation: Mastering Spear Phishing and Mass Phishing Techniques

- WordPress SEO Poisoning and Impersonation Risks

Detecting Business Email Compromise

Because BEC attacks often bypass technical controls, detection relies on behavioral indicators and contextual analysis:

- Email sent from a known user but with unusual timing or language

- Unexpected changes to banking details or payment instructions

- Unusual login locations (e.g., credentials used from abroad)

- Domain names that differ by a single character

Advanced email security gateways, SIEM correlation rules, and identity monitoring can help catch anomalies.

🔗 Related guides on threat visibility:

- How to Build a SOC from Scratch

- Blue Team Strategies: Threat Detection and Response

- Detecting Ransomware in Real-Time

Preventing BEC with Security and Policy Controls

To protect against BEC, organizations need a combination of technical hardening and organizational policies:

Technical Recommendations:

- Enforce multi-factor authentication (MFA) on all email accounts

- Deploy DMARC, SPF, and DKIM to prevent spoofing

- Use DNS filtering to block known malicious domains

- Monitor login anomalies and email forwarding rules

Policy-Based Controls:

- Establish dual authorization for wire transfers and payment changes

- Educate employees on BEC red flags

- Encourage out-of-band communication to verify high-risk requests

- Document and test an incident response plan for fraud scenarios

Post-Incident Lessons and Remediation

In the event of a successful BEC attack, rapid action is key:

- Notify banks immediately to initiate fund recovery

- Investigate the initial vector (e.g., credential reuse, phishing)

- Review email logs for further compromise

- Update training and improve financial verification workflows

Also, report incidents to relevant authorities and law enforcement agencies.

🔗 Continue reading:

- Data Breaches: How to Know If Your Information Has Been Leaked

- Advanced Web Application Security

- DevSecOps: Integrating Security into DevOps

Conclusion

Business Email Compromise is a silent, stealthy threat that exploits trust, urgency, and human error. It’s low-tech but high-reward for attackers, making it vital for organizations to deploy layered defenses, enforce authentication policies, and raise security awareness across all departments.

While technology can help detect suspicious behavior, the real defense lies in employee vigilance, strong internal controls, and continuous adaptation to evolving attack techniques.