Fraud Prevention in the Digital Age: Strategies, Technologies, and Real-World Defenses

In today’s hyperconnected world, fraud prevention is no longer a matter of protecting payment systems alone. It now spans identity verification, behavioral analytics, insider threat monitoring, and real-time anomaly detection. As fraudsters evolve, so must our strategies.

This article explores how cybersecurity professionals can design effective anti-fraud programs to protect enterprises, customers, and infrastructure.

The Expanding Landscape of Digital Fraud

Fraud today affects every layer of the enterprise. It can manifest as:

- Business Email Compromise (BEC)

- Account takeover and credential stuffing

- Social engineering and phishing

- Invoice fraud and payroll redirection

- Synthetic identity creation

- Ransomware combined with extortion tactics

🔗 To understand BEC threats more deeply, read Business Email Compromise: Understanding the Threat and Building Effective Defenses

🔗 Explore the basics of phishing with Phishing Simulation: Mastering Spear Phishing and Mass Phishing Techniques

Key Principles of Modern Fraud Prevention

Fraud prevention should not rely on static rules or after-the-fact investigations. Instead, it must be proactive, adaptive, and risk-based.

The core pillars include:

- Identity assurance at every user interaction

- Continuous authentication and user behavior monitoring

- Segregation of duties and least privilege principles

- Real-time risk scoring using machine learning

- Alert correlation across systems (SIEM/SOC)

🔗 Learn how to build this capability in How to Build a SOC from Scratch

🔗 Reinforce your perimeter with Web Application Security Best Practices

Fraud Prevention Technologies You Should Deploy

✅ Identity & Access Management (IAM)

Ensure strong authentication, including multi-factor authentication (MFA). Detect impossible travel and session hijacking anomalies.

✅ Device Fingerprinting

Recognize and track devices through unique configurations, OS versions, browser plugins, and behavioral profiles.

✅ Behavioral Biometrics

Use machine learning to detect fraud based on typing rhythm, navigation habits, or mouse movement anomalies.

✅ Threat Intelligence

Correlate internal logs with threat intelligence feeds to detect compromised accounts or known fraud IPs.

🔗 Enhance your visibility with Detecting and Mitigating Ransomware on Windows Servers

🔗 If working in the finance sector, review Application Security for E-Banking and Mobile Payments

Process and Policy-Based Defenses

Fraud prevention isn't just technical—it's operational. Establish:

- Clear financial workflows with dual authorization

- Incident playbooks for fraud scenarios

- Periodic fraud simulations to test response

- Whistleblower mechanisms to detect insider fraud

- Customer education campaigns to reduce social engineering risk

🔗 Learn from blue team frameworks in Blue Team Strategies

🔗 Dive into Active Directory hardening with Advanced Active Directory Security

Combining Fraud Detection with Threat Hunting

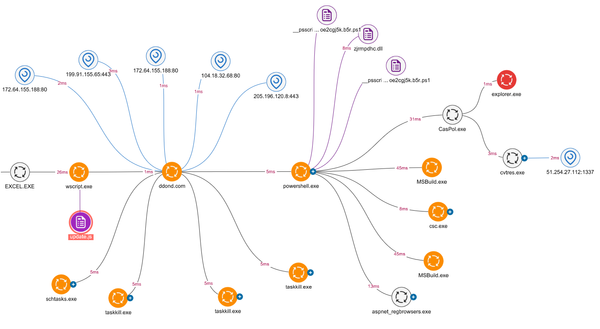

Advanced teams today combine fraud analytics with threat hunting:

- Hunt for fraudulent behavior using LSASS dump traces, abnormal process injection, or NTLM relay activity

- Apply indicators of compromise (IOCs) to internal data to spot abnormal behavior early

🔗 Expand your expertise with Dumping LSASS Memory for Credential Extraction

🔗 Investigate lateral movement in NTLM Relay Attacks

Conclusion

Effective fraud prevention is not about blocking one transaction or one IP address. It’s about building an adaptive architecture that evolves alongside threats, blends technical rigor with user education, and integrates seamlessly into your security stack.

Fraud will continue to evolve—but with the right mix of controls, detection, and awareness, your organization can stay several steps ahead.